Find Outstanding Student Loans Balance | Federal Student Aid

How To Find Your Federal Student Oan Balance

Using The National Student Loan Data System

To find your current federal student loan balance, you can use the National Student Loan Data System (NSLDS), a database run by the Department of Education.

When you enroll in a college or university, the school administration sends your loan information to NSLDS. The database also pulls information from loan servicers and government agencies, so it’s a comprehensive overview of all FSA you’ve received.

- Create an account with your Federal Student Aid ID and log in

- Track of your student loan in your name, including original amount, current balance, interest rate, monthly payment status, and loan servicer

- Visit your multiple loans website to create an account, make payments online and ask any questions you may have

While NSLDS is useful, there are some limitations:

Not always up-to-date: To look up your account information on NSLDS can be up to 120 days old, so it may not be an up-to-date view of your loan.

Not all loans are listed: NSLDS only contains information about Title-IV eligible loans and grants, so if you take out another borrower — such as loans for medical or nursing school programs—they won’t appear on NSLDS superior. Pay off finding your student loan refinance are also not listed.

Contact Your School’s Financial Aid Office

If you have federal loans that do not appear on NSLDS, another option is to contact your school’s financial aid office. The staff there can look up your past loan information, including what you borrowed initially and who the loan servicer was. With this information, you can contact the servicer to get your current loans.

How To Find Your Private Student Loan Balance

Because NSLDS only applies to federal loans, your private student loans will not appear in the database. These also don’t appear if you refinance any federal loans, because once you refinance your student loan debt, they become plans that works could end up owing loan changed.

To find any private student fee balances (or check who your lender is):

- Get your credit report from three national database agencies – Experian, Equifax and TransUnion – at AnnualCreditReport.com (you can do it for free once a year)

- Check your minimum amount due every month for a list of all your current obligations, including student loans. It will list how much you have borrowed and who the federal director is.

- Contact a loan servicer to begin making repay or begin the student loan refinancing process

Where Can I Find My Loan Information?

An important factor in keeping up with private student loan payments is knowing where to find all student loan information. StudentAid.gov is the U.S. Department of Education’s comprehensive database of private and federal student loans. This is your one-stop shop for all your federal student loan information.

Advantages:

- Your calculator student loan amount and balance

- Your loan servicer and its contact information

- your interest rate

- Your current loan status (repayments, defaults, etc.)

How to started:

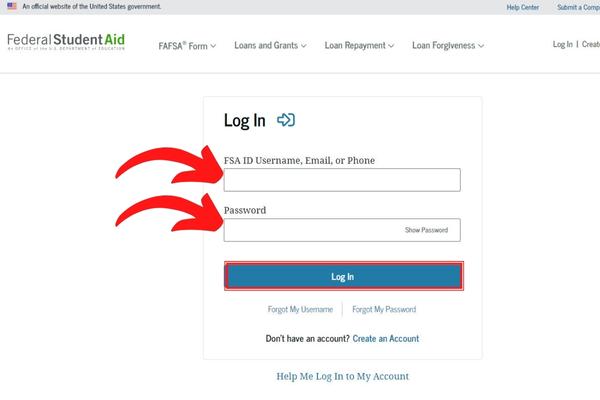

- Go to StudentAid.gov

- Click to “Log In“

- Have your FSA ID ready. This is the same username and password you used to electronically sign the FAFSA. To learn more about FSA IDs, visit studentaid.gov.

- If prompted, enter your name, social security number, date of birth, and FSA ID.

- Read the Privacy Statement. You must accept these terms to use StudentAid.gov.

- Select “ Log In“

Note: StudentAid.gov can be an invaluable tool for you to track your student loan information. Checking StudentAid.gov and speaking with your loan servicer will give you the information you need to get back on track with your student loan repayments.

read more: https://seattleducation.com/find-outstanding-student-loans/

Comments

Post a Comment